Bawumia launches MyCreditScore, pioneering Credit Scoring System in Ghana

Accra, Ghana - Nov 7, 2024 - Ghana has taken a significant step towards financial inclusion with the launch of MyCreditScore, a personalized credit reference and scoring system.

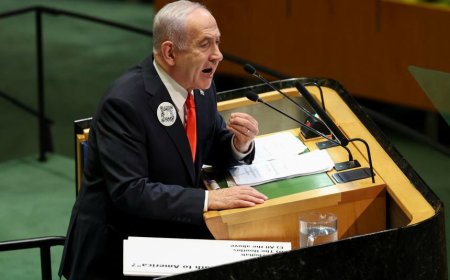

Vice President and Presidential Candidate of the NPP, Dr. Mahamudu Bawumia backed by the Central Bank, unveiled the system today November 7, 2024, to provide Ghanaians with a transparent way to demonstrate their creditworthiness.

This innovative platform revolutionizes credit access for Ghanaians, providing a streamlined, cash-free way to make purchases and fostering financial responsibility.

Dr. Bawumia described the launch as a "momentous occasion" and a "step forward in building a dynamic credit economy for Ghana".

He expressed satisfaction at realizing a personalized credit scoring system, which began in 2007 during his tenure as Deputy Governor of the Bank of Ghana.

According to Dr. Bawumia, MyCreditScore will empower citizens and benefit financial institutions by promoting responsible lending practices. The initiative aims to reduce Non-Performing Loans (NPLs) affecting financial institutions in Ghana.

At the launch event in Accra on Thursday, Dr Bawumia described the credit scoring system as a "momentous occasion" and a "step forward in building a dynamic credit economy for Ghana and all Ghanaians." He noted, “It is a significant milestone in Ghana’s journey towards a financially inclusive and empowered society,” adding that the launch of myCreditScore represents "yet another chapter in the nation’s ambitious journey towards financial inclusion."

“The absence of a credit information system has increased lending risks, leading financial institutions to offer less credit,” Dr Bawumia noted. “A credit reporting system in Ghana will provide timely, accurate, and up-to-date information on debt profiles and borrowers’ repayment history, yielding numerous benefits.”

“This initiative comes at a crucial time for Ghana’s financial sector. Recent data from CEIC Data shows that, as of August 2024, Ghana’s non-performing loan (NPL) rate stands at 24.3%, with a peak of 26.7% earlier this year.” High NPL levels have indicated challenges within Ghana’s financial ecosystem, and the lack of a standardised, transparent credit scoring system has increased risks for lenders and limited financial inclusion for borrowers.

“The introduction of myCreditScore is a pivotal step toward addressing these challenges, aligning Ghana’s credit ecosystem with international standards, and promoting a culture of responsible borrowing,” Dr Bawumia added.

The Vice President highlighted positive outcomes from a pilot project, saying, “Results from the myCreditScore pilot show a stark improvement, achieving an NPL ratio of just 1.4%, a remarkable contrast to the 20.7% average reported in 2023 by the Bank of Ghana.”

“This initiative reflects a broader commitment to sustainable economic growth, where financial stability and trust in credit practices play foundational roles,” he remarked. “With systems like myCreditScore, Ghana is positioned to transition into a financial ecosystem that facilitates responsible borrowing and lending practices, driving economic resilience and inclusive growth for all stakeholders.”

“The purpose of the Credit Reporting Act (Act 726) is to provide a legal and regulatory framework for credit reporting in Ghana,” he explained. “The availability of credit information is widely recognised as essential for the development and maintenance of an effective financial sector, as borrowers often have a natural incentive not to disclose negative information about themselves.”

“My thanks go to the Governor of the Bank of Ghana, the management and staff, for making this possible. This credit scoring initiative you have licensed and which we are launching today is a major achievement, and Ghana will forever be grateful.”

He added, “I am also thrilled that this initiative is a homegrown Ghanaian private-sector effort. We will continue to support our private sector in championing such initiatives in digital and other sectors.”

He concluded with optimism: “Let us move forward with purpose, knowing that together we’re building a Ghana where financial inclusion is real, dreams are within reach, and every Ghanaian has the chance to achieve financial security and prosperity. It is possible!'', he stated.

Source: Lead News Online