We will implement tier banking system in next NDC gov’t — Mahama

Mr. John Dramani Mahama, the Flagbearer of the largest opposition party, the National Democratic Congress, has pledged a tier banking system in the next NDC government.

The initiative, he asserted, would enhance financial inclusion and cater for the peculiar financial needs of every segment of Ghana’s economy, particularly the informal sector.

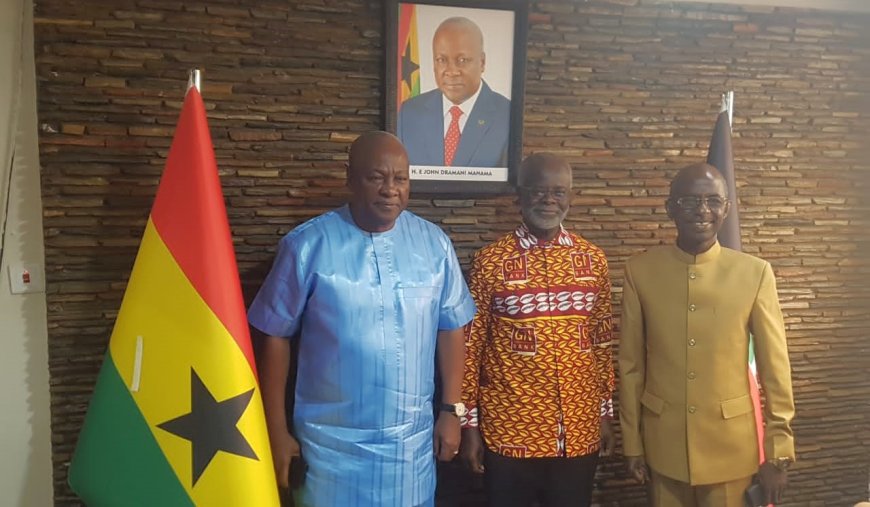

He said this when the management of Groupe Nduom presented a petition to him on the restoration of the defunct Groupe Nduom (GN) Bank license should be win the December polls.

“All banks require a certain capital reserve, which is why we are calling for a tiered banking system because banks exist for different purposes and have different objectives. They cater to different segments of the market in an economy. Not every bank needs to be a Class A bank with a capital reserve of 400 million cedis. There are small banks that cater to specific segments of the market, and they do not need 400 million cedis in capital.”

He criticised the government for its “hasty and knee-jerk” decision to shut down banks that were having liquidity challenges.

He said the criteria used to collapse the banks were not fit for purpose and lacked a comprehensive approach, emphasising that “it was just like different rules for different people”.

Mr. Mahama also bemoaned the dominance of foreign banks in Ghana’s financial sector and stated his intention to improve the fortunes of local banks when elected.

The next NDC government he pledged, would have a “sympathetic approach” to the collapsed banks and called for a review of the process.

In August 2018, the Bank of Ghana undertook a clean-up exercise, which led to the revocation of the licenses of five banks.

In the case of GN Bank, the Central Bank advised the financial institution to reclassify and change its operations to become a savings and loan company.

However, in a subsequent decision, the Central Bank revoked the Savings and Loans license of GN Savings and Loans citing regulatory breaches.

Dr. Paa Kwesi Nduom, Founder, Groupe Nduom, urged the NDC to reassess the revocation of the defunct bank’s license, adding that the banking sector was facing serious stress.

According to Dr. Nduom, GN Bank collapse was detrimental to Ghana’s economic interests.

He said the absence of GN Bank had left a significant gap in the country’s attempts to promote financial inclusion.

Source: GNA