"All possible legal recourse will be sought," it said in a statement.

Shares of Adani Group firms fell more than 10% in Thursday morning trade with the group losing more than $20bn in market capitalisation. Adani Green Energy, which is the firm at the centre of the allegations, also said it wouldn't proceed with a $600m bond offering.

The conglomerate has been operating under a cloud since 2023, when US short-seller Hindenburg Research published a report accusing it of decades of "brazen" stock manipulation and accounting fraud.

The claims, which Mr Adani denied, prompted a major market sell-off and an investigation by India's market regulator Securities and Exchange Board of India (Sebi).

Later, Hindenburg also accused Sebi's chief Madhabi Puri Buch of having links with off-shore funds used by the Adani group - both Ms Buch and the group have denied this.

Reports of the bribery probe into the company have been circling for months. Prosecutors said the US started investigating the company in 2022, and found the inquiry obstructed.

They allege that executives raised $3bn in loans and bonds, including from US firms, on the backs of false and misleading statements related to the firm's anti-bribery practices and policies, as well as reports of the bribery probe.

“As alleged, the defendants orchestrated an elaborate scheme to bribe Indian government officials to secure contracts worth billions of dollars and... lied about the bribery scheme as they sought to raise capital from U.S. and international investors,” US Attorney Breon Peace said in a statement announcing the charges.

“My office is committed to rooting out corruption in the international marketplace and protecting investors from those who seek to enrich themselves at the expense of the integrity of our financial markets,” he added.

On several occasions Mr Adani met personally with government officials to advance the bribery scheme, officials said.

Michael Kugelman, director of the South Asia Institute at the Wilson Center, called the charges a "body blow" to the tycoon.

"For the last nearly two years, Mr Adani has been trying to rehabilitate his image, and [trying] to show that those earlier fraud allegations levelled by the Hindenburg group were not true, and his company and his businesses had actually been doing quite well," he told the BBC's Business Today programme.

But it might be harder for the billionaire, he said, to "shake off" the allegations made by US authorities.

US investment firm GQG Partners LLC, which has invested nearly $10bn in the Adani Group, has said that it is "monitoring the charges" and may take "appropriate" actions for its portfolios.

Moody's Ratings said that the indictment was a "credit negative" for the group's firms.

"Our main focus when assessing Adani Group is on the ability of the group’s companies to access capital to meet their liquidity requirements and on its governance practices," it said.

The issue is also likely to set off a political storm in India.

Mr Adani is a close ally of Indian Prime Minister Narendra Modi. He has long faced claims from opposition politicians alleging that he has benefited from his political ties, which he denies.

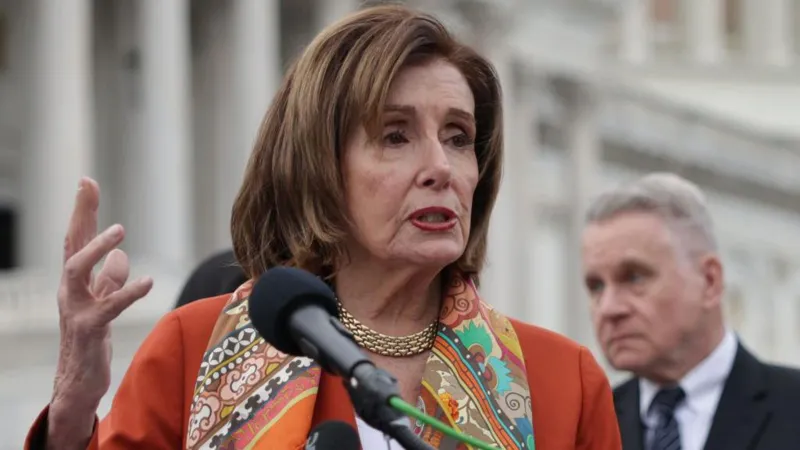

Opposition leader Rahul Gandhi demanded in a press conference that Mr Adani should be arrested and that Ms Buch should be removed from her position as Sebi chief.

The US Attorney positions in the US are appointed by the president. The filing comes just weeks after Donald Trump won election to the White House, pledging to overhaul the US Justice Department.

Last week on social media, Mr Adani congratulated Trump on his election win and pledged to invest $10bn in the US.

Source: BBC