Global media bias costs Africa $4.2 billion annually—new report reveals

A recent report reveals that Africa loses up to $4.2 billion annually in inflated interest payments on sovereign debt, largely due to negative stereotypes perpetuated by international media.

The research, conducted by Africa Practice and Africa No Filter, highlights the significant economic impact of biased media coverage, which often portrays the continent in a negative light and deters potential investment.

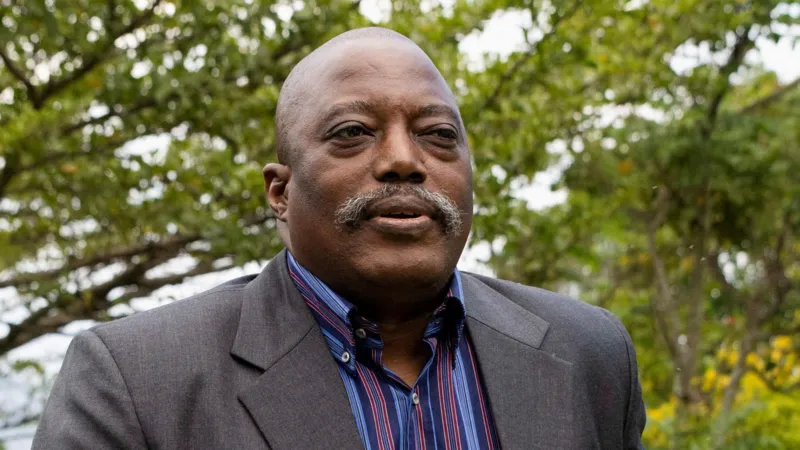

“We’ve always known that there’s a cost to the persistent stereotypical media narratives about Africa. Now we’re able to put an actual figure to it,” said Moky Makura, executive director of Africa No Filter. “The scale of these figures underscores the urgent need to challenge [these] negative stereotypes about Africa and promote a more balanced narrative.”

Biased reporting on African elections

The report emphasises that global media coverage of African elections is particularly problematic, often focusing on conflict, corruption, poverty, and poor leadership. This portrayal creates a significant gap between perceived and actual investment risks, further reducing Africa’s attractiveness to international investors.

African elections are frequently covered with an overemphasis on violence and fraud, while positive stories about progress and development are often ignored, the study indicates.

“Typically, election coverage is narrowly focused on the horse race between the incumbent and main opposition party or parties. In Africa, it is often peppered with stories of election violence and rumours of corruption,” Makura explained. “The fixation on election drama rather than the issues at stake is sometimes driven by the desire for headline-grabbing stories. It’s easier to sell stories about tainted politicians and violent clashes than it is to dig into healthcare reform or job creation policies.”

Africa vs. the ‘Rest of the World’

The study highlights stark disparities in media coverage between African and non-African countries with similar political and socioeconomic conditions. For example, Malaysia, which experienced a corruption scandal during the same period as Kenya, saw significantly fewer global news articles on corruption compared to Kenya.

A key finding is that 88% of global news articles about Kenya and 69% about Nigeria are negative, compared to just 48% for Malaysia. Similarly, Egypt, whose political regime and press freedom are comparable to that of Thailand, had more headlines focused on violence than its Southeast Asian counterpart.

When compared to other African nations, South Africa and its president, Cyril Ramaphosa, have received more favourable reporting in the media; however, there are media narratives that portray South Africa as failing like other African nations. This disproportionate focus on negative stories in Africa skews global perceptions and plays a role in the continent’s higher borrowing costs.

Higher interest rates due to media bias

According to the study, negative media sentiment directly influences credit ratings and bond yields, which in turn increase borrowing costs for African nations. Egypt, for example, has a negative sentiment score of 66% and faces bond yields of around 15%, while Thailand, with a sentiment score of 32%, has bond yields of just 2.5%.

African nations often pay significantly higher interest rates compared to other regions. The United Nations Conference on Trade and Development (UNCTAD) Secretary-General Rebeca Grynspan revealed that African countries pay about eight times more in interest than European countries and four times more than the US for the same level of debt.

According to the research, inflated rates are largely driven by heightened perceptions of risk influenced by media portrayals, despite some countries having decent credit ratings.

“The real commercial opportunity is obscured from international investors because of this risk premium,” noted Marcus Courage, chief executive officer of Africa Practice. He added that the $4.2 billion figure only accounts for the impact of negative media on sovereign debt, excluding broader effects on tourism, foreign investment, or aid.

Reducing the debt burden

More economic restrictions are being placed on the people of various African countries as a result of the adoption of additional levies, increased taxes, and other revenue-enhancing measures to pay off debt.

With the World Bank reporting that nine African countries entered 2024 in debt distress, and many more at high risk, the report concludes that a more balanced and accurate media portrayal of Africa could reduce borrowing costs, allowing African countries to invest more in public infrastructure and other critical needs.

Source: Global South World