SIM swap fraud hits Ghana: GHȼ4.6 Million lost in 2023 - BoG reports

Accra, Ghana - The Bank of Ghana has sounded the alarm on a rising trend of SIM swap fraud, resulting in a staggering loss of GHȼ4.6 million last year.

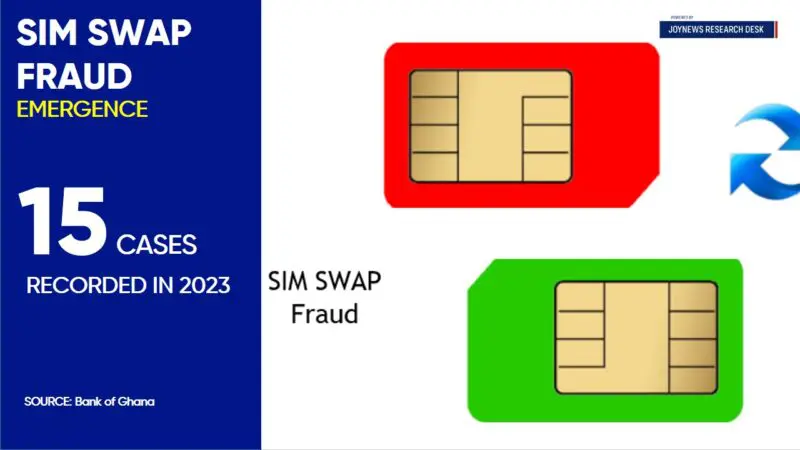

According to the central bank, 15 recorded cases of SIM swap fraud were reported in 2023, targeting individuals with access to mobile banking channels.

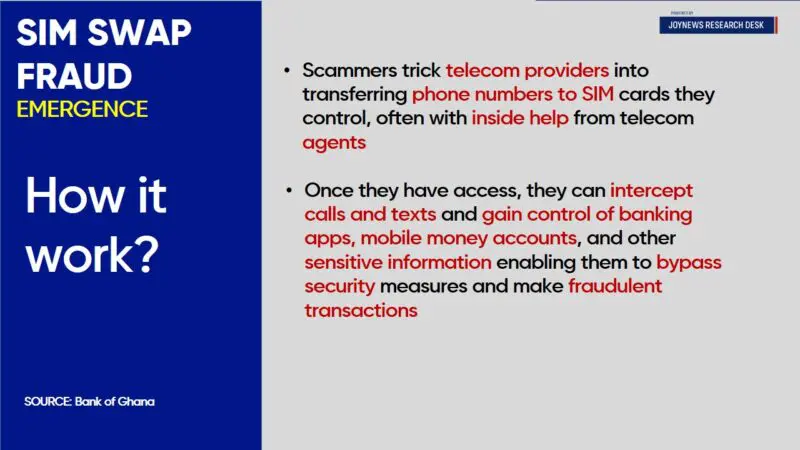

Scammers trick telecom providers into transferring victims' phone numbers to SIM cards they control, often with inside help from telecom agents.

This allows them to intercept calls, texts, and sensitive information, bypassing security measures to make fraudulent transactions.

Ransford Nana Addo Junior, a Certified Fraud Examiner and Financial Crime & Fraud Lecturer at the National Banking College, says "It is not only individual accounts. When a SIM swap happens on corporate accounts, it's more dangerous. For instance, if the CFO of a hotel has his number swapped and a fraudulent transaction is initiated, the fraudsters will be the ones receiving the confirmation."

He also cautioned that SIM swap fraud extends beyond individual accounts.

"It goes beyond just the mobile channels and even beyond banking. For instance, if somebody wants to intercept your medication information sent through SMS or your SSNIT records, it can be intercepted through SIM swap as well," he added.

The Bank of Ghana has directed payment service providers to deactivate electronic money accounts for two days when swapping or replacing SIM cards. Accounts can be reactivated once customers present valid identification.

Ghana saw a 5% increase in overall fraud cases in 2023, resulting in a loss of GHS 88 million.

To avoid falling victim, individuals are advised to be cautious with personal information, regularly monitor accounts for suspicious activities, and contact service providers and banks quickly if they suspect fraud.

The development has sparked concerns about the need for enhanced cybersecurity measures to protect consumers.

As the use of mobile banking continues to grow, experts warn that SIM swap fraud will remain a significant threat unless urgent action is taken.

Source : Lead News Online